Cardano founder Charles Hoskinson used the opening of a Midnight workshop in Sapporo (Japan tour) on Jan. 25 to frame Midnight as Cardano’s “crown jewel” and a missing primitive for mainstream crypto adoption, arguing the privacy layer is positioned to outpace incumbent privacy-focused networks within 12 months.

Why Cardano’s Midnight ‘Eclipses’ All Privacy Projects

Hoskinson told attendees that while crypto spent the past decade perfecting transparent ledgers, it never built a first-class “private side” that real businesses and regulators can work with. “When you have the yin and yang, well, we only built one side of the yin and yang. We only built the transparent side. We didn’t build the private side,” he said. “So the challenge is that blockchains, every single one of them, they’re missing something. They’re missing a component that’s required for real-life business.”

In his telling, the gap sits at the intersection of privacy-enhancing technology (PET), compliance, and an emerging “abstraction” stack aimed at making crypto usable without forcing consumers to learn how blockchains work. Hoskinson argued that regulated activity like KYC/KYB/AML requires selective disclosure, but public chains force a tradeoff between compliance and privacy. “If you share information about yourself on a public network, everyone in the world, everywhere in the world, gets to see that,” he said. “That doesn’t make any sense. That doesn’t make sense to do commerce.”

He extended the same logic to intent-based execution and account abstraction-style UX, where users describe outcomes and a solver network routes liquidity and settlement across chains. “If I know your intentions, I can trade against you,” Hoskinson said, warning that revealing price bounds or execution constraints invites adverse selection. “Never tell me your intention because I can use it against you. So, intentions also require privacy.”

Midnight, he said, is designed to supply those primitives without demanding wholesale migration to a new Layer 1. Hoskinson described the network as built for “hybrid applications” across multiple ecosystems, claiming Midnight’s launch architecture connected it to “eight different ecosystems, seven different blockchains,” so users can stay on chains like Solana, Cardano, Bitcoin, or Ethereum while invoking Midnight’s privacy features.

He also positioned Midnight as a catalyst for Cardano’s DeFi ambitions, acknowledging a participation gap between staking and on-chain application usage. “There’s 1.4 million people staking, but only about 50,000 people participating on a monthly basis in our DeFi ecosystem,” Hoskinson said, adding that the next phase is to upgrade a subset of leading Cardano dApps so they can tap Midnight and market privacy-native products—such as private DEXs, prediction markets, or stablecoins—to users from other ecosystems.

On rollout, Hoskinson said the first stage of Midnight launched in December and that the first mainnet is “very soon” to follow. He highlighted what he characterized as an unusually retail-heavy distribution: “We never sold a single token. We just gave it away,” he said, claiming ADA holders received more than 50% of supply and that early trading activity surpassed $9 billion in volume and more than $1 billion in value.

Hoskinson closed with his boldest projection: “Within a year, Midnight is going to eclipse anybody in the privacy space because we know how to solve these problems,” he said, attributing the edge to the depth of Cardano’s research bench.

“Because we hired 168 scientists, and they happen to have spent the last four decades of their life chasing this. One of the guys working on this wrote the first computer game online. He was at Stanford when they were building the internet, [...]. He wrote Pong, and it was the first online game. That’s the legacy we have. Now, 40 years later, he’s a fellow in the Royal Society, the same society that Sir Isaac Newton was a member of. He’s working on this, as is that 22-year-old graduate student, as is the developer here in Japan, and everyone in between, and that’s why we’re going to win. It’s not a US cryptocurrency. It’s global,” Hoskison said.

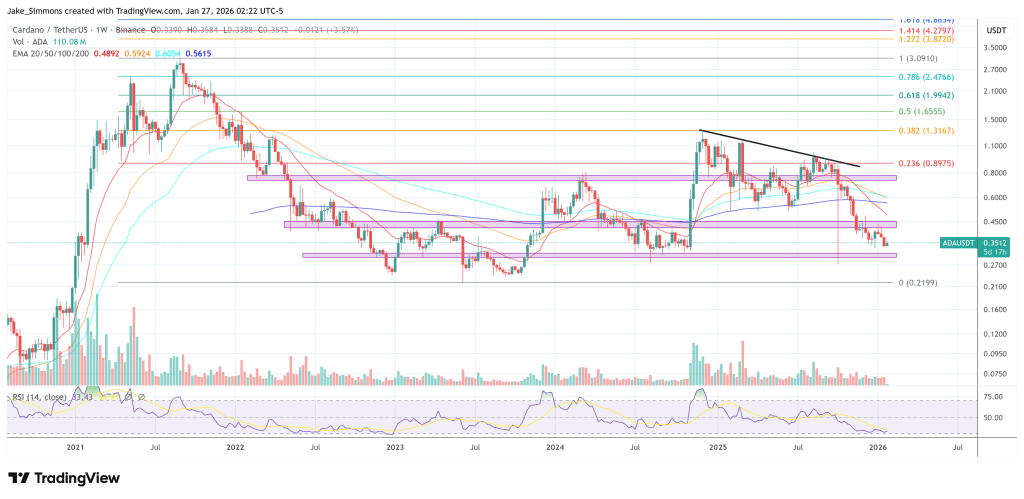

At press time, ADA traded at $0.3512.